There's been some speculation that Amazon might be creeping into Google's (search) territory.

In some ways, that's at least partially true. Amazon has showed some promise of potentially overtaking Google's paid ads business, and its market share of product searches (54%) outnumbers that of Google's (46%).

But not all search is created equal. We dug a little deeper into the numbers, looking at a recent report and running our own surveys to see how people search for different types of information.

The Info-Seeking Market Share

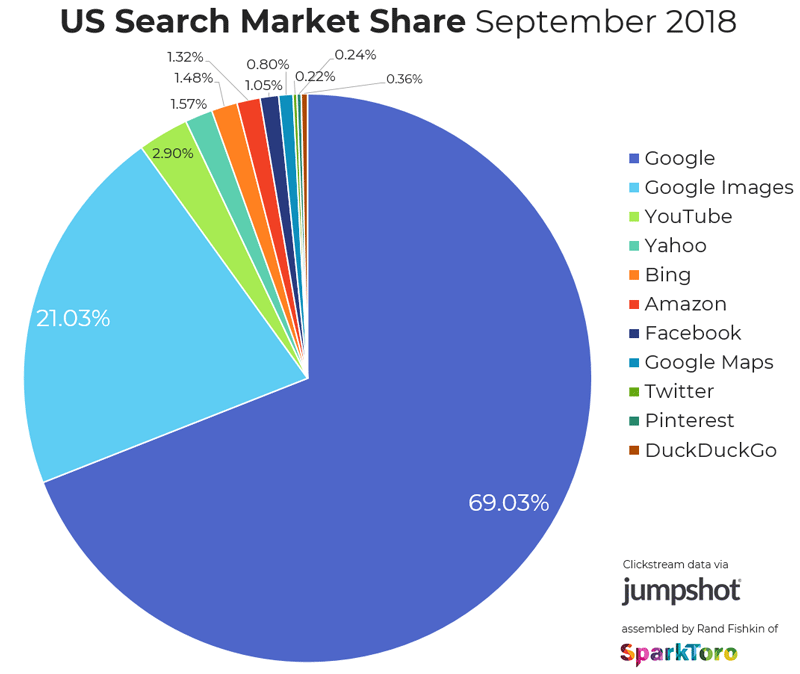

While it may be true that Amazon is gaining on Google's share of product-specific searches, when it comes to general information searches, Google still reins supreme.

According to a recent report from SparkToro, Google's domination in the area of general search traffic is quite significant, with 90% of web searches taking place on its site. That includes not only the primary Google search bar, but also, queries taking place on its Images and Maps products.

Source: SparkToro

To see how that information might uphold among a census-style audience, we asked 860 people across the U.S., UK, and Canada: Which resource do you most commonly use when searching for information online?

Data collected with Lucid

Our results lined up with SparkToro's, with 82.7% of respondents indicating that Google is their primary resource for finding information online.

When including respondents who chose "Google Maps" or "Google Images," that number increases to 84.7%.

The Product-Seeking Market Share

Here's where things start to get interested. As we previously mentioned, studies show that over half of all product searches take place on Amazon. And, according to our own previous data, people are more likely to buy something based on an ad they saw on Amazon, versus an ad they saw on Google.

However, when we asked 827 people across the U.S., UK, and Canada -- Which resource do you most commonly use when searching for products online? -- the results looked a bit different.

Data collected with Lucid

Here, only 10% of respondents said they use Amazon as the primary resource for searching for products.

A few things could explain that -- namely, it's possible that survey participants use Google as the primary source of information to seek information like the "best" products in a certain category.

As Andrea Leigh of Ideoclick, a company that works with manufacturers to optimize online sales, explained at Code Commerce in September -- Amazon is most effective when it comes to specific, niche product searches. Think: queries like, "Probiotics for children." That could one source, for instance, of the aforementioned 54% figure.

So, Does Amazon Stand a Chance?

When it comes to general searches, it could be quite some time before Amazon can see eye-to-eye with Google's traffic. As Rand Fishkin, author of the SparkToro study put it, "Google [has] a near-monopoly" of web searches.

But that doesn't mean Amazon should be completely discounted, for a number of reasons -- a major consideration being voice search. In 2017, for instance, eMarketer found that 70.6% of smart speaker users owned an Amazon Echo, versus the 23.8% who used a Google Home.

However, we don't know if those uses pertained to information-seeking or product-buying -- and other studies have shown that even if it's not used by as many people, Google's Assistant (the voice assistant that powers the Google Home smart speaker) answers questions correctly 17% more of the time than Amazon's Alexa.

Another key question to ask when looking at this data: Does Amazon actually view Google as a threat? And, is its primary goal or concern to reign supreme in the world of web searches?

"If you view search as a pie, sure, Amazon doesn’t have a huge piece of it," says Keith Anderson, SVP of Strategy & Insight at Profitero, an eCommerce performance analytics platform. "Amazon isn’t particularly threatened by Google as a search engine [and] has a different business model that has different incentives."

So, for Amazon, product search could remain the name of the (winning) game -- especially when it comes to understanding the intent behind those searches.

"What Amazon is building really quickly is an ad network and targeting capability at the intersection of ads, and the ability to buy really seamlessly," Anderson explains. "Because they have so much information about buyer intent and buyer behavior, they can build a level of targeting that’s very hard for Google to match."

In other words, he says -- for now -- there's no need for Amazon "to try to out-Google Google."

offshore vps

ReplyDeleteoffshore vps

offshore vps

offshore vps

offshore vps

offshore vps

offshore vps